By: Jeff Klump,

President of K4 Architecture + Design

Menu

Follow us on:

In the dynamic landscape of community banking, where the strength of relationships is paramount, the role of design extends beyond aesthetics—it becomes a strategic catalyst for talent acquisition and retention. In an era where attracting and retaining top talent is pivotal for organizational success, the significance of an intentionally designed workspace cannot be overstated. In this article, we delve into how strategic design decisions can not only enhance the physical environment but also foster a culture of engagement, innovation, and long-term commitment among employees, contributing to relationship building and the overall prosperity of community banks. Join K4 on this journey through the intersection of design and community banking, where the blueprint for success lies in the spaces we create for those who make our banks the heart of the community.

“A study by Capital One found that 67% of employees believe the physical work environment reflects company culture.”

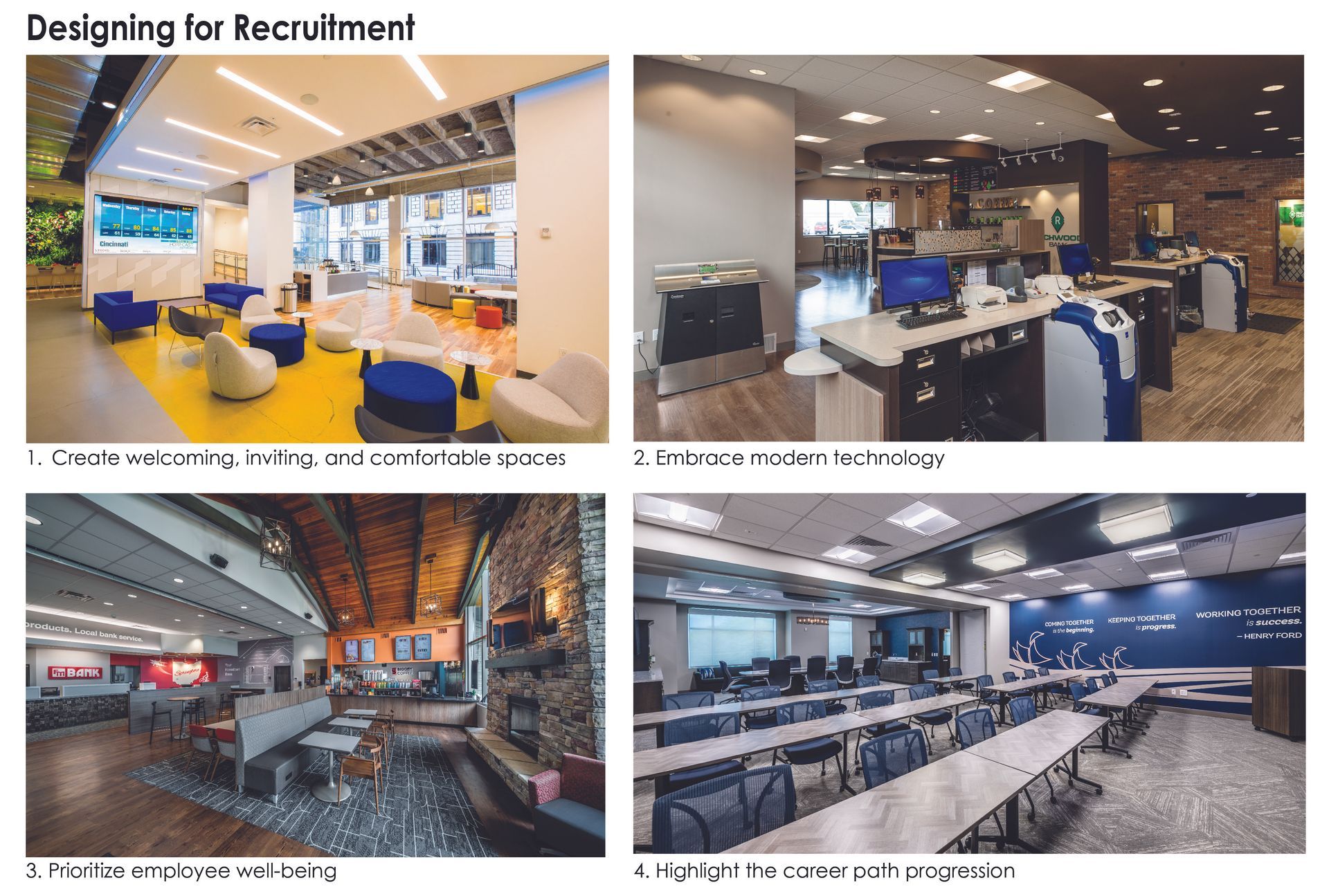

One of the first steps is ensuring that your facility design aligns with your community bank’s brand and culture. The exterior and physical environment should convey your values and the experience you offer to employees and customers, but also reflect your commitment to your brand.

“A Leesman Index survey found that 87% of employees believed that the quality of their workplace had an impact on their overall productivity.”

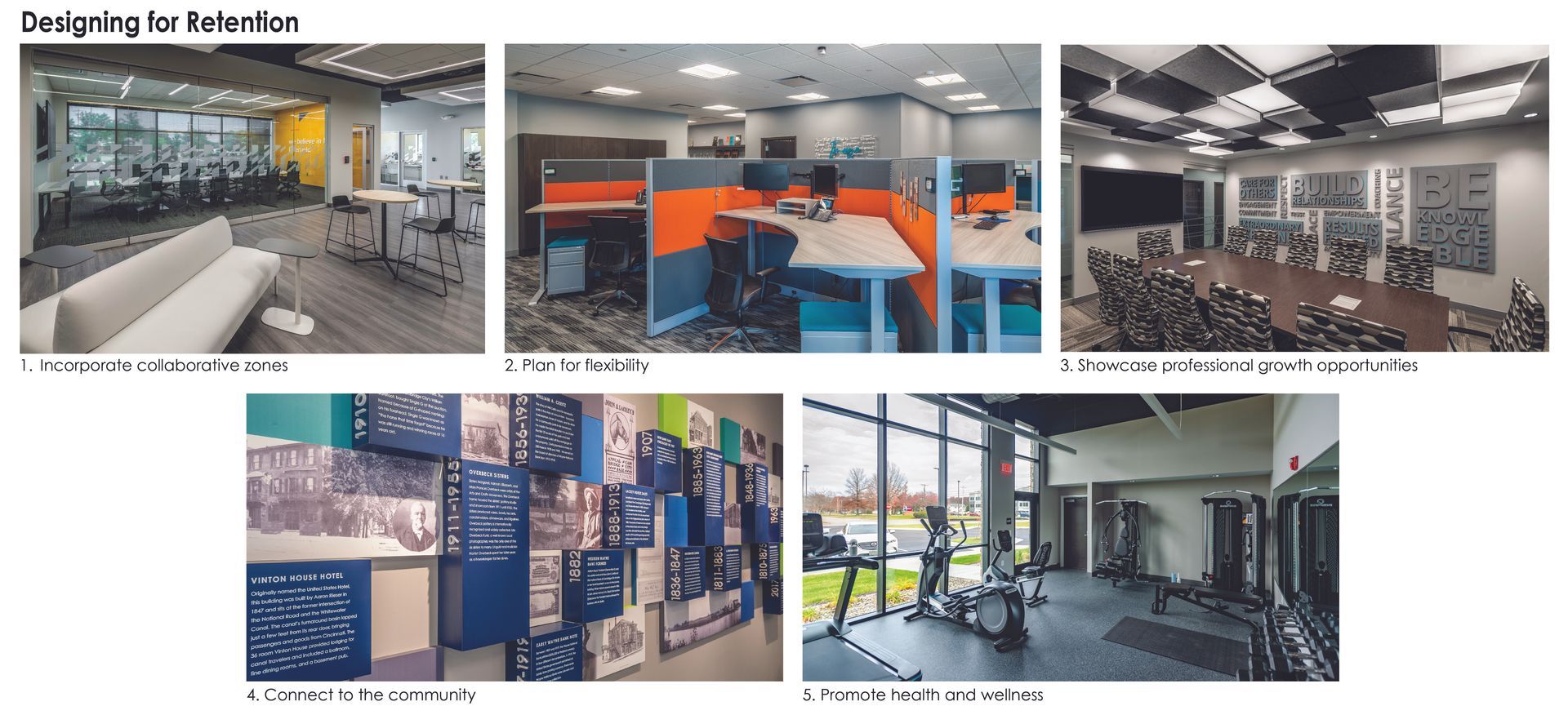

Tactful design decisions can not only enhance the physical workspace but also become a cornerstone for cultivating a workplace environment that beckons employees to stay, thrive, and contribute to the enduring success of community banks.

In essence, using facility design for employee retention is about creating an environment where employees feel valued and supported. It's about fostering a workplace culture that makes them want to stay and contribute their best to your community bank’s success.

This isn't just an article; it's a testament to the transformative power of design and investing in your organization. It's a reminder that the physical space we provide for our employees is not just walls and furniture – it's a canvas where the culture and values of our organizations come to life. When we invest in an environment that reflects our dedication to our team's well-being, we create a magnetic force that attracts talent and cultivates loyalty.