By: Jeff Klump,

President of K4 Architecture + Design

Menu

Follow us on:

Now more than ever, brand consistency is of utmost importance to financial institutions. Creating brand consistency goes a long way in building brand trust, increasing customer/employee/community loyalty, and impacting your bottom line. Why is there so much brand inconsistency in the community banking landscape? Because being brand consistent requires change and commitment, and it can be tedious and expensive. Taking the first step is often overwhelming. Where do you start? What do you update first? These are excellent questions, but there are other important questions to consider.

What is the cost of NOT getting brand consistent or what is the cost or potential loss of creating brand confusion? Inconsistencies are costing your bank time and money. Not practicing brand consistency will cost you significant consequences to customer experience, brand reputation, and overall loss of trust – all of which can impact your bottom line. Conflicting brand usage accounts for a damage to brand credibility, making it harder to compete in the market.

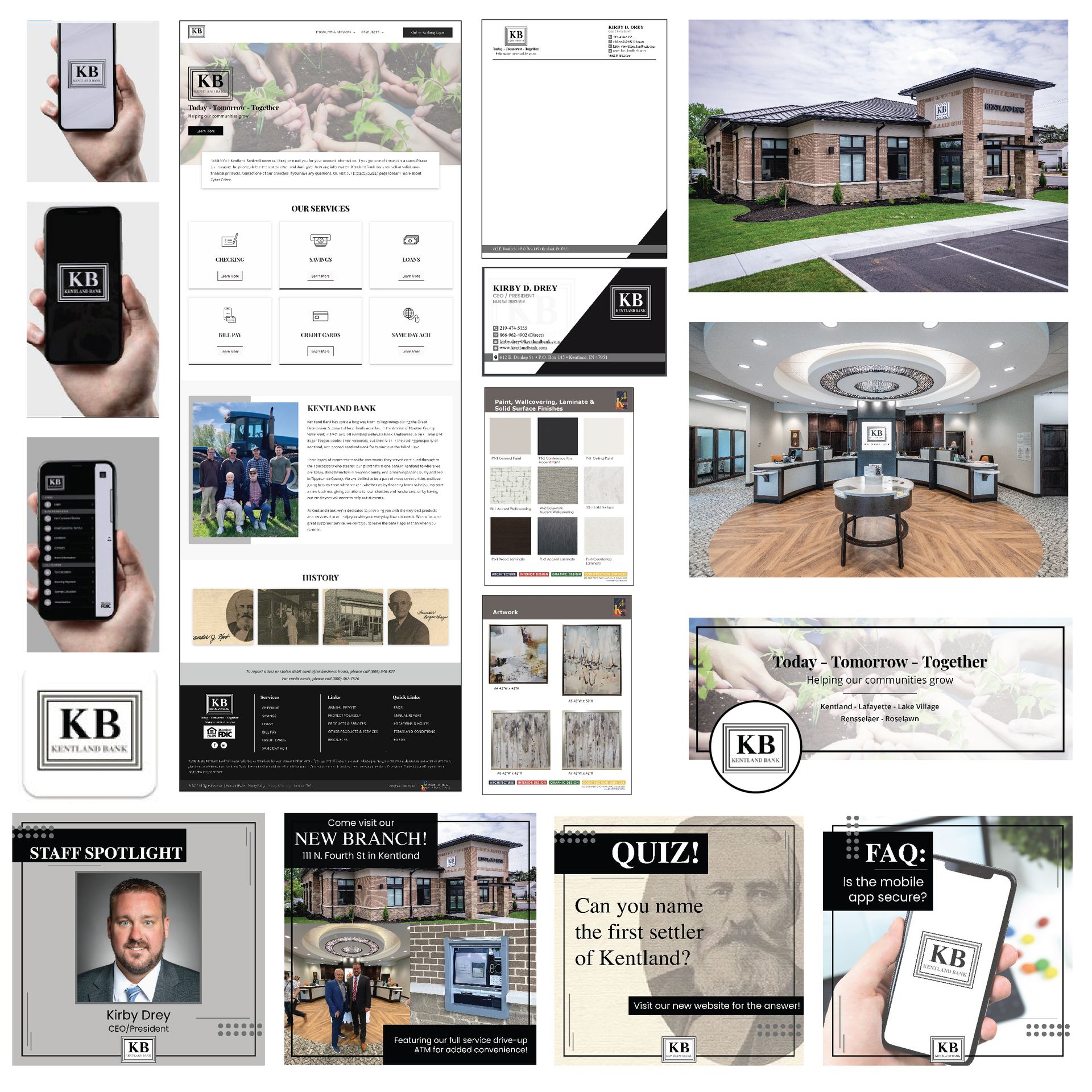

As K4 gets ready to hit the road in 2023, presenting at various community banking conferences on this topic, we thought it was important to preamble this timely subject of the Financial Success Puzzle. At K4, we define the Financial Success Puzzle as a 3-piece formula to creating and maintaining brand consistency for community banks. This formula is simply the act of connecting people to place and connecting brand identity to place. Many retailers have capitalized on this concept for years. Your branch facilities, marketing & people MUST work together to create stability and not only that…they must be triplets, not just siblings. They can’t just resemble one another; they need to be nearly identical in their delivery.

The approach to the design of your branches should be focused around transforming them into physical manifestations of your brand and using design to appeal to different demographics in your branch network to meet the needs of your communities. Second, a mindset shift from "thinking like a bank" to "thinking like a brand" is a game changer in terms of branch design and small changes in your day-to-day thinking including the marriage of your brand and branch technology.

It is no coincidence that the 5 keys to success in retail facilities can also be applied to the branch facility and are defined in this order: location; marketing; branch layout & appearance; customer service and bundle selling.

If you are considering a branch update, new build or remodel – you ought to be equally considering a simultaneous brand update including your physical and digital marketing assets. What does this mean? It means that the design of your facilities anchors your branding effort. At K4, our family of companies work together and the facility designers provide the design elements used in the exterior and interior to our marketing department to formulate brand standards and create a cohesive look throughout the financial success puzzle. Ultimately branches are your number one touch point, they should be your brand anchors, and the first step to achieving brand consistency and building brand equity.

As mentioned above, using a remodeled or newly built branch and unveiling rebranding simultaneously is the ultimate scenario. The typical update path for a financial institution typically goes something like this:

FACILITY > WEBSITE > MOBILE > SOCIAL MEDIA > PRINT.

The design and branding elements dictated in the facility design are applied throughout the rest of your digital and physical marketing assets in cohesive manner. Facility, website and mobile are often completed in tandem, as no one wants to remodel a facility and have their customers say, “Is this the same place?” when logging into an outdated website or mobile banking app. Next, we suggest considering planning out social media to include one to two organic, branded posts per week following the natural cycles of community banking and mixed in with staff spotlights, community support, employee and bank milestones, and holiday content. The goal here of organic content is brand awareness – to remind the community you are there when and how you need them, and that you are a proud neighbor.

Think of your website, social media and other digital marketing efforts as chauffeurs, each should be focused on driving traffic to the branch so your skilled staff can sell. If you do seek direct response or to make the phone ring – be mindful of how much time you devote to creating content with your audience count in mind. Using paid social media to leverage larger audiences around mortgage loans, credit applications, etc, can be beneficial.

While branch design for employee recruitment and retention should certainly be part of your branding strategy, this article focuses on design for your people as your internal branding efforts should always be turned on. Employee experience should be strongly considered in the design or remodel of your facilities, in equal weight to customer experience. Employee believers are instrumental in creating brand experience and connection to the customers. Afterall, the entire experience should be about building those strong lasting relationships with your customer base, and your employees have the power to solidify these connections.

Says Scott Gardener in Forbes – “Your employee’s interactions with customers become your authenticity ‘litmus test’ based on how they facilitate your company’s purpose. Any brand can position itself how it wants, but how does that positioning hold up during customer engagements?”

No matter what you say your brand is, it’s your employees who must live and breathe it every day from your front-line staff, to admin, to management. This is called putting your brand into operation and you must ensure that your staff know how to live your brand. Many companies mistakenly put forth stellar branding efforts, only to fail to connect the dots to everyday employees. The single biggest threats to your brand don’t come from competition, they come from bad customer experiences, and that threat is internal. One negative interaction will destroy years of great branding as we’ve seen when brands are attacked on social media by customers, and the virality of such negative messaging as the word spreads. Just ask the airlines if you don’t believe us!

The key takeaway here - never assume that your employees know your brand and are delivering on your brand promise.

In order to create a long lasting and consistent branding effort, you must embrace the three pieces of the Financial Success Puzzle – Facilities, Marketing & People - and implement them correctly into your organizational DNA. The result? Your brand consistency will reward brand awareness, which will yield brand equity for years to come.