By: Nicole DeRogatis,

CMO of K4 Marketing + Branding

Menu

Follow us on:

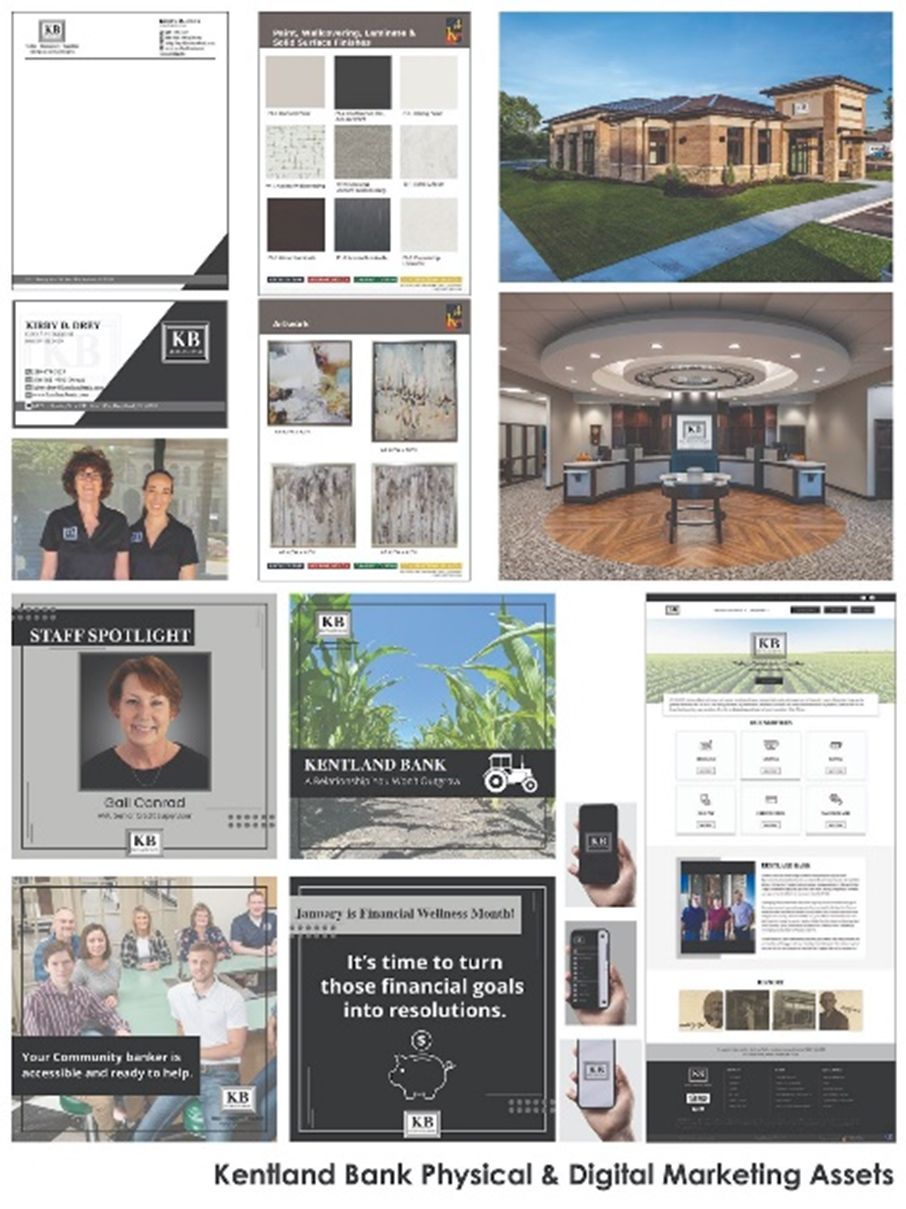

In the previously published Journey to Brand Consistency: Part I, K4 addressed Facilities, Marketing & People as the three pieces that comprise the Financial Success Puzzle for community banks. This article examines one level deeper in unifying physical and digital marketing assets within the Financial Success Puzzle, and the importance of creating a harmonious and powerful brand identity across all platforms.

In the fast-paced and ever-evolving community banking industry, maintaining a strong and recognizable brand presence is vital for success. As a full-service design and branding firm working closely with community banks, we have witnessed the transformative power of consistent marketing assets in bridging the gap between the physical and digital realms. By solidifying the customer experience across all touchpoints, banking institutions can establish a stronger emotional connection with their customers and create a lasting impact on their success. Investing in brand consistency is not only a strategic move but also a reflection of a bank's commitment to their own stability and future growth.

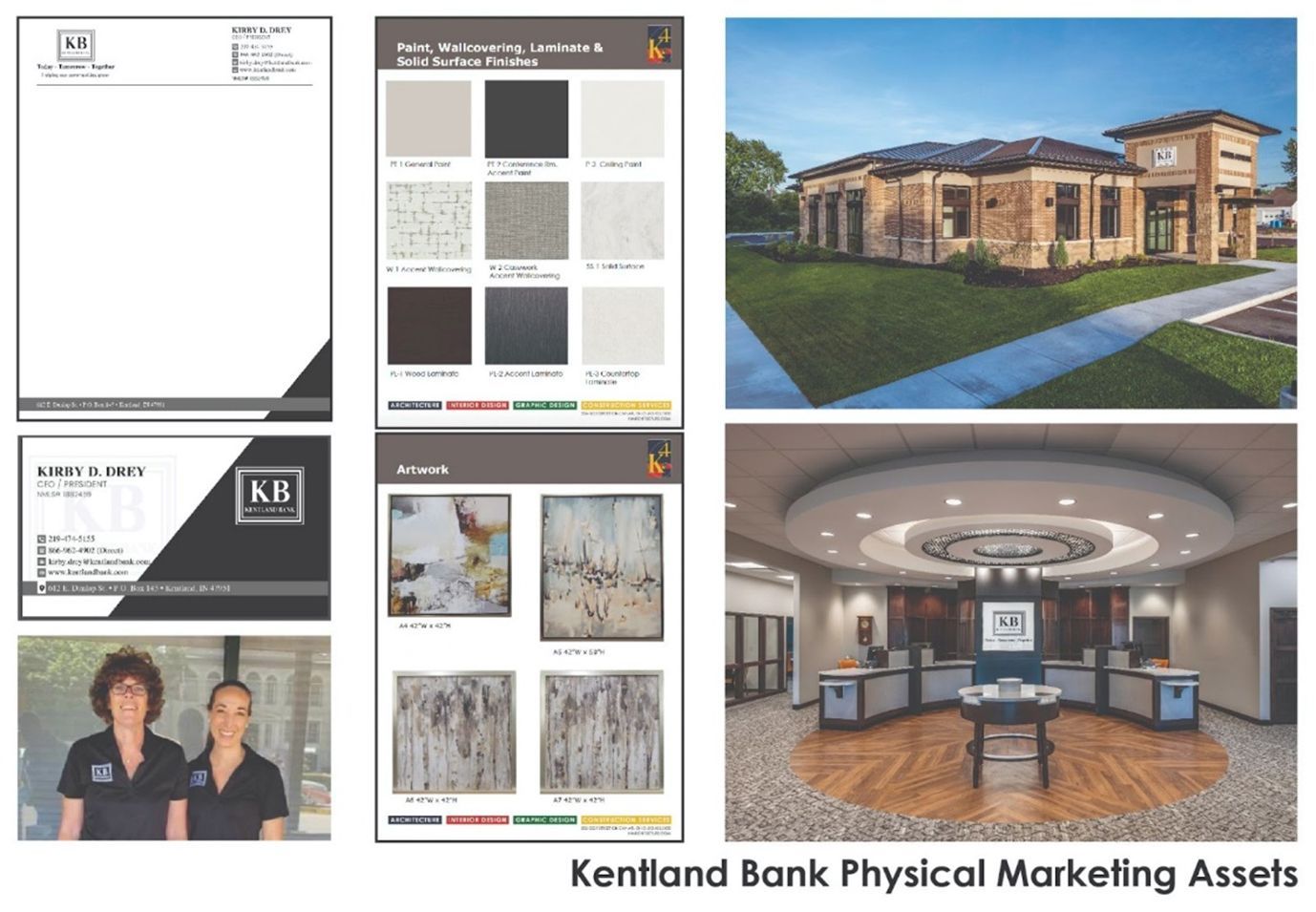

Physical Marketing Assets

Branch & Main Office Facilities, Logo, Signage, Print Marketing Collateral, People

Presenting a universal front when it comes to your physical marketing assets communicates professionalism and reliability. For customers, a bank that exudes these positive traits is more likely to be perceived as secure and dependable. Whether customers visit a physical branch, consult with drive thru staff, interact with your bank at a community event, or receive a piece of direct mail from you; maintaining unvarying design and messaging fosters confidence in the brand.

Visual elements are the bedrock of brand identity. From logo design, to material pallets, to color schemes; they create a memorable and cohesive experience across your organization. When these brand elements remain uniform across physical branch(es), signage, and print marketing materials; customers can instantly recognize and associate them with the bank, fostering brand loyalty and recognition. When templates, color schemes, and messaging are already in place, it significantly reduces the time and effort required to roll out new campaigns. This leads to cost savings and an improved return on investment (ROI) for your organization. Automated systems that centralize brand guidelines ensure that all materials are up-to-date and accessible to all relevant stakeholders. This streamlines collaboration, reduces errors, and enhances brand consistency.

The consistent nature of your bank’s physical marketing assets also play a pivotal role in aligning people with the brand; meaning employees, customers and the surrounding community as a whole. When employees are immersed in a dependable brand identity, they become brand advocates, or brand ambassadors. This alignment boosts their sense of pride in their work, leading to enhanced customer interactions and overall satisfaction.

In the competitive banking landscape, it’s no surprise that exceptional customer service and how you operationalize it daily stands as a pivotal differentiator. When financial services can often seem impersonal and technology-driven, community banks have a unique opportunity to establish themselves as pillars of reliability through unparalleled customer experiences. The personal touch of dedicated relationship bankers who genuinely understand the local community's needs and aspirations fosters a sense of connection that transcends transactional interactions. By going beyond mere financial transactions to offer tailored solutions, attentive assistance, and a welcoming atmosphere, community banks can cultivate well-founded connections to their customers. This in turn, rewards customer loyalty, positive word-of-mouth referrals, and an invaluable reputation for being an approachable financial resource and partner. Banking choices are abundant, and community banks can effectively set themselves apart by embracing exceptional customer service as their hallmark, reinforcing their role as indispensable anchors within their respective locales.

Banking institutions play an important role in fostering a sense of community. Investments into your branding don’t go unnoticed and allow banks to reflect their values and commitment, which is crucial for building trust with community members. As a branding and design firm, we understand that banking institutions are not just financial entities; they are integral parts of the fabric of local neighborhoods. This connection is what transforms community banks from mere businesses into trusted partners, deeply embedded in the lives of the people they serve.

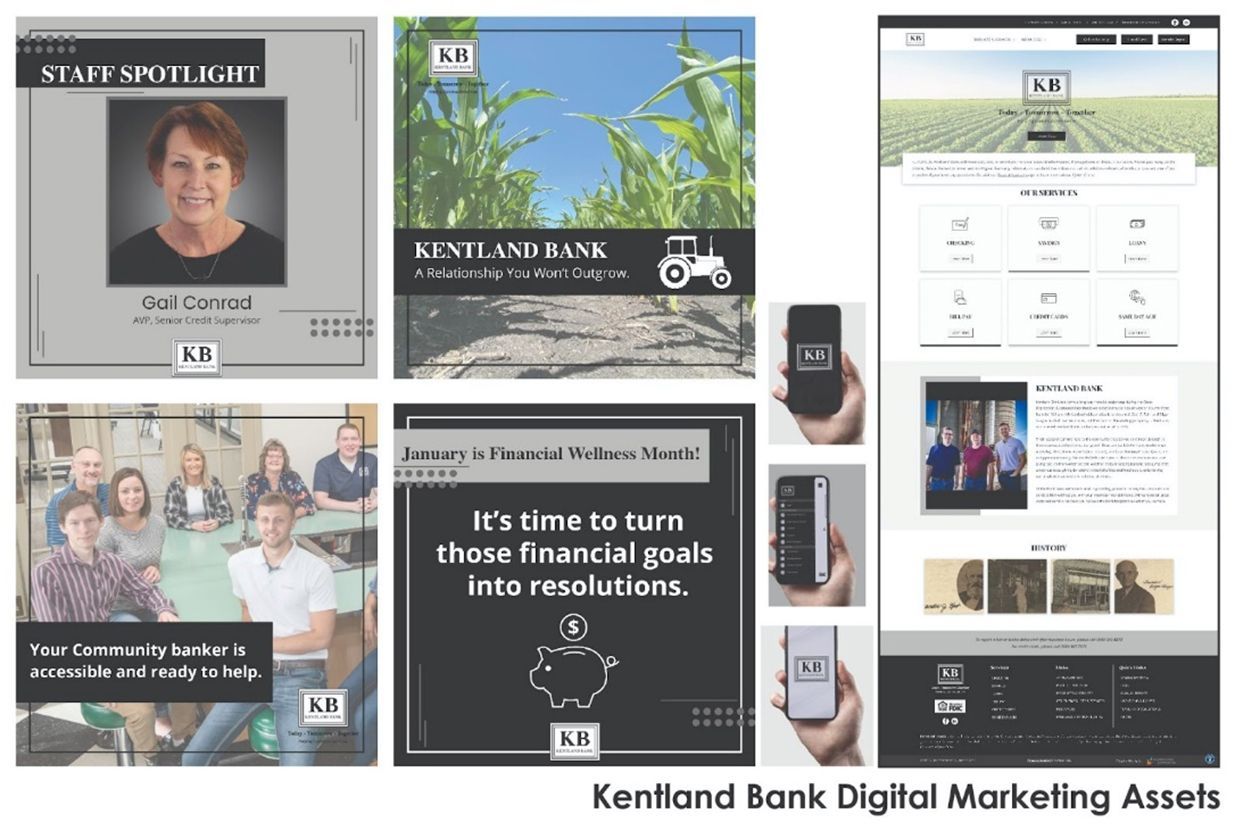

Digital Marketing Assets

Website, Online Banking, Mobile App, Email Marketing, Social Media, Digital Documents

Consistency in digital marketing assets is paramount to your bank’s success as it serves as the visual and conceptual glue that binds together all aspects of your online presence. The rise of digital marketing has expanded the avenues for banking institutions to engage with customers. However, this has also introduced the challenge of maintaining messaging across numerous digital channels. By implementing a congruent digital branding strategy, banks can maintain their identity and resonate with customers on various online platforms, from website to mobile app to social media to email marketing.

Achieving consistent digital branding involves a strategic and systematic approach. Starting with the website, your bank’s visual brand elements are applied to create a user-friendly, responsive, and visually cohesive interface. This design framework then extends to mobile apps, ensuring a duplicate user experience across devices. Social media platforms come next, where your voice, imagery, and design elements align to create a recognizable presence. Moving on to email marketing, the bank's visual identity is applied to templates, ensuring that each email reflects the bank’s ethos. Regular audits and updates are essential to adapt to evolving design trends and ensure that the brand remains relevant.

In the age of digital transformation, banking institutions must ensure that their customers experience a seamless transition between physical and digital touchpoints. This means aligning the design, branding, and messaging of both in-branch and online experiences. By mirroring the same design principles, customers can effortlessly navigate between the two worlds, promoting a sense of continuity. Your bank's website, mobile app, email campaigns, and social media efforts must mirror the visuals and messaging seen in the physical branch location(s), signage, and print marketing materials. When customers interact with a brand both online and offline, encountering the same color schemes, logos, design elements, and messaging fosters a sense of familiarity. It's through this approach that a bank can effectively convey its values and commitment across all touchpoints. As the financial landscape continues to evolve, maintaining brand consistency will remain a key unique selling proposition and driver of growth in the years to come.